What is the Exness Profit Calculator?

The Exness Profit Calculator is an essential tool for traders who want to make quick and accurate financial calculations before entering a trade. It allows you to easily calculate various aspects of your trade, such as margin requirements, pip value, and spread costs, helping you understand the potential risks and rewards of each position. The calculator simplifies complex calculations, allowing traders to focus more on strategy and less on manual math. This tool is especially helpful when trading multiple instruments, whether forex, stocks, or commodities, ensuring you understand the exact financial impact of your trade before executing it. By using the Exness Profit Calculator, traders can enhance their decision-making process, optimize their trading strategies, and better manage their risk.

Key Features of the Exness Trading Calculator

The Exness Calculator is not just a simple tool; it comes packed with several key features that make it indispensable for traders. Whether you’re a beginner or an experienced trader, this calculator helps you gain a better understanding of your potential trades by providing quick and accurate results. It’s designed to assist in calculating profits, losses, margin requirements, and swap costs, making it an essential tool for managing risk and planning trades effectively.

Exness Margin Calculator

Exness Pips Calculator

Exness Spread Calculator

How to Use the Exness Calculator

Using the Exness Calculator is easy and straightforward, providing quick insights into potential trade outcomes. It helps traders make informed decisions by calculating profits, losses, and margin requirements. Follow these steps:

- Access the Exness Calculator. Visit exness.com and log in. Go to the “Tools” section and select “Exness Calculator.”

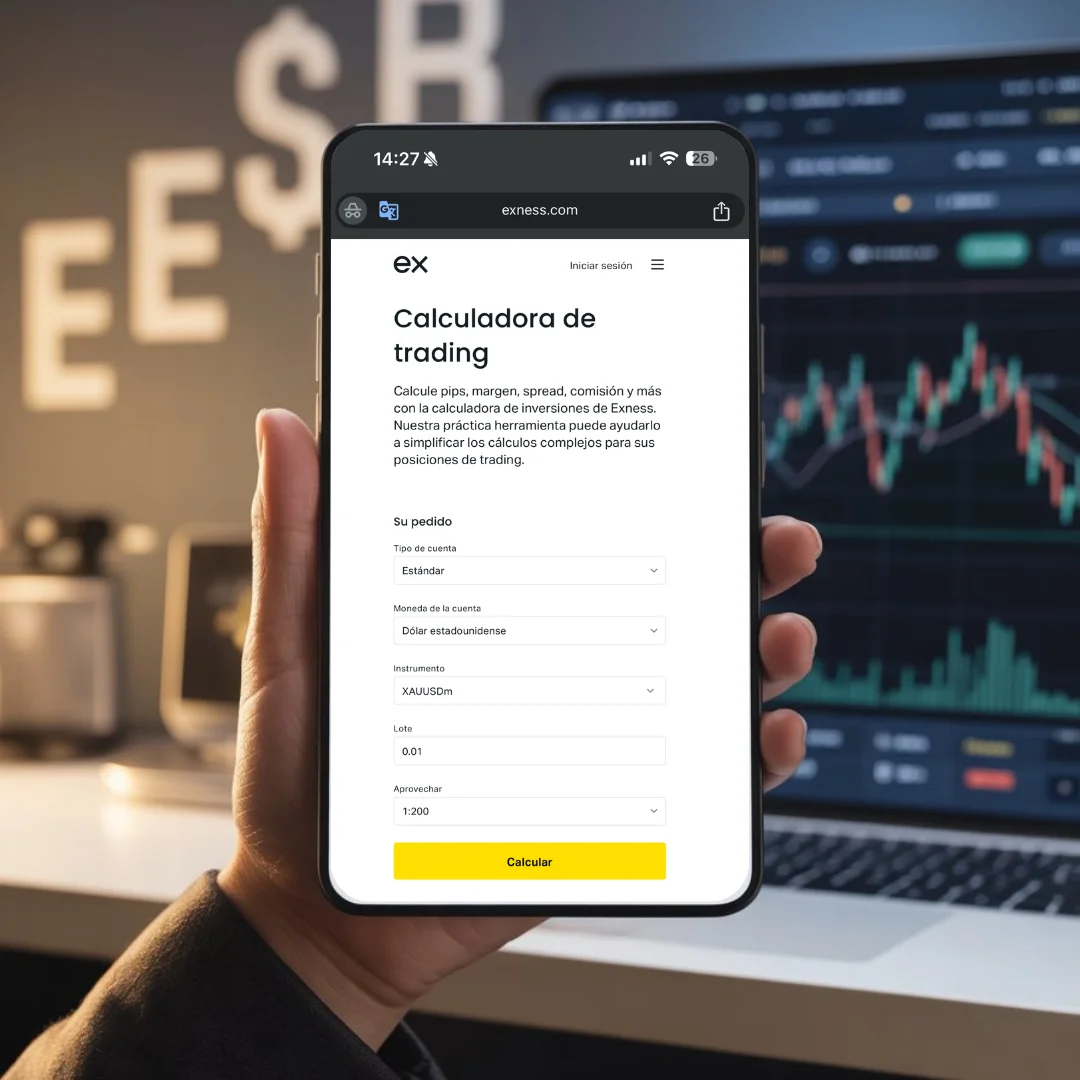

- Choose Your Account Type. Select your account type (e.g., Standard, Raw Spread) from the dropdown menu.

- Select Your Account Currency. Choose the currency in which your trading account is denominated (e.g., USD, EUR).

- Choose the Trading Instrument. Pick the instrument you want to trade (e.g., EUR/USD, XAU/USD) from the dropdown list.

- Enter the Lot Size. Input the size of your trade (e.g., 1 lot for a standard position, 0.1 for a mini lot).

- Set Your Leverage. Choose your leverage ratio (e.g., 1:100, 1:500).

- Calculate. Click the “Calculate” button to get your results.

- Interpret the Results. Review the margin requirement, spread cost, commission, swap rates, and pip value.

- Adjust Inputs if Necessary. Modify the parameters if needed and recalculate.

- Use the Results. Use the calculated results to plan and execute your trade with confidence.

Input Parameters

To use the Exness Calculator effectively, you’ll need to input key parameters related to your trade. Each of these parameters will influence your profit or loss calculation, helping you plan your trades with precision. Here are the most important input parameters to consider:

| Parameter | Description | Example |

| Account Type | The type of trading account you are using. Options include: Standard, Raw Spread, Zero, Pro, Cent. | Standard |

| Account Currency | The currency in which your trading account is set up. Common options include: USD, EUR, GBP, JPY. | USD |

| Instrument | The financial product you want to trade. Options include: currency pairs (e.g., EUR/USD, GBP/JPY), metals (e.g., XAU/USD for gold), indices, cryptocurrencies. | EUR/USD |

| Lot Size | The size of your trade. For example: 1.0 for a standard lot, 0.1 for a mini lot, 0.01 for a micro lot. One standard lot equals 100,000 units of the base currency. | 1.0 |

| Leverage | The ratio that allows you to control a larger position with a smaller amount of money. Options include: 1:50, 1:100, 1:200, 1:500, 1:1000, 1:2000, up to 1:unlimited. | 1:500 |

These input parameters are essential for determining the potential outcomes of your trade, allowing you to better understand how different values can affect your trading strategy. Once you’ve entered this information, the Exness Calculator will generate results that help you make more informed decisions. Adjusting these parameters can help optimize your risk management and improve your overall trading performance.

Results

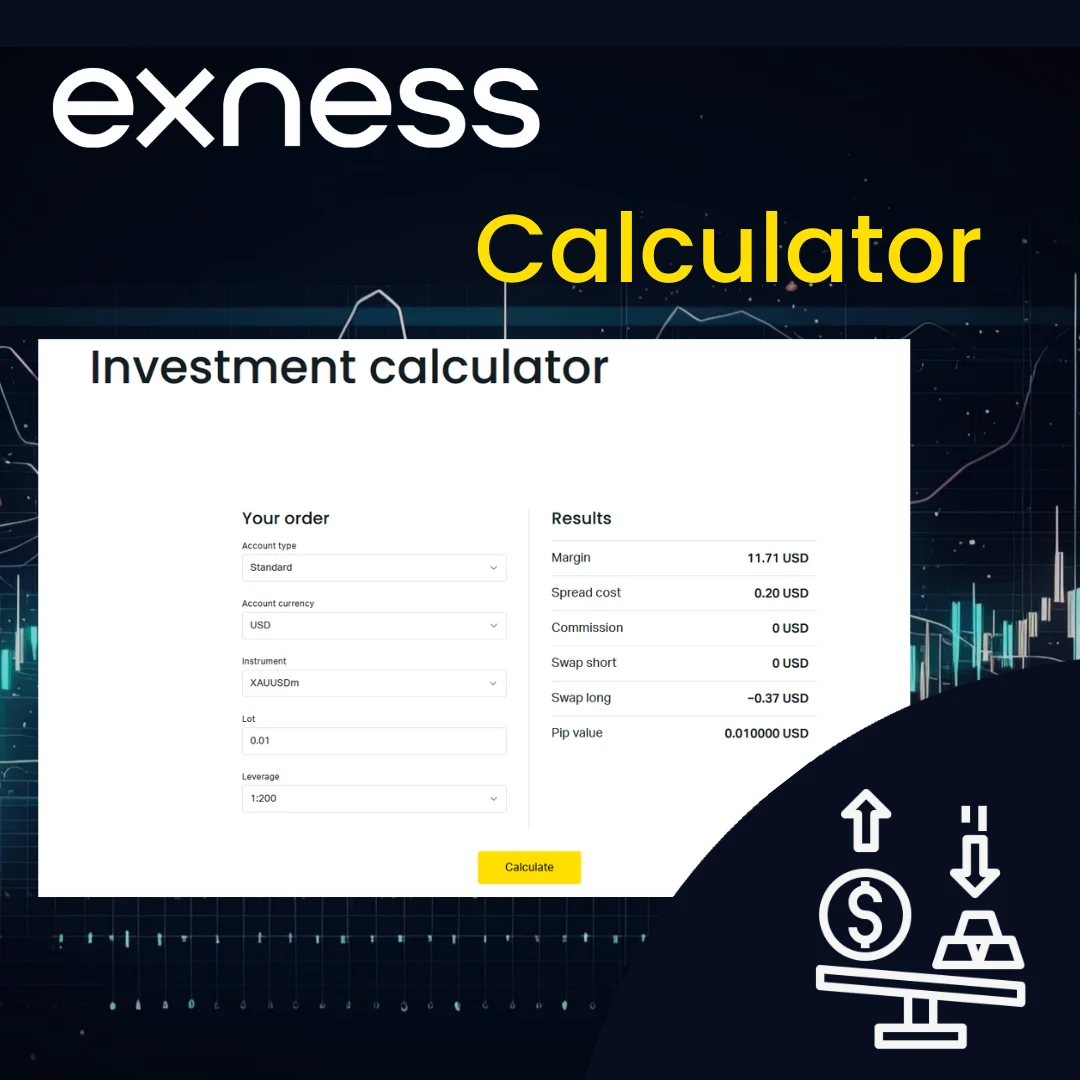

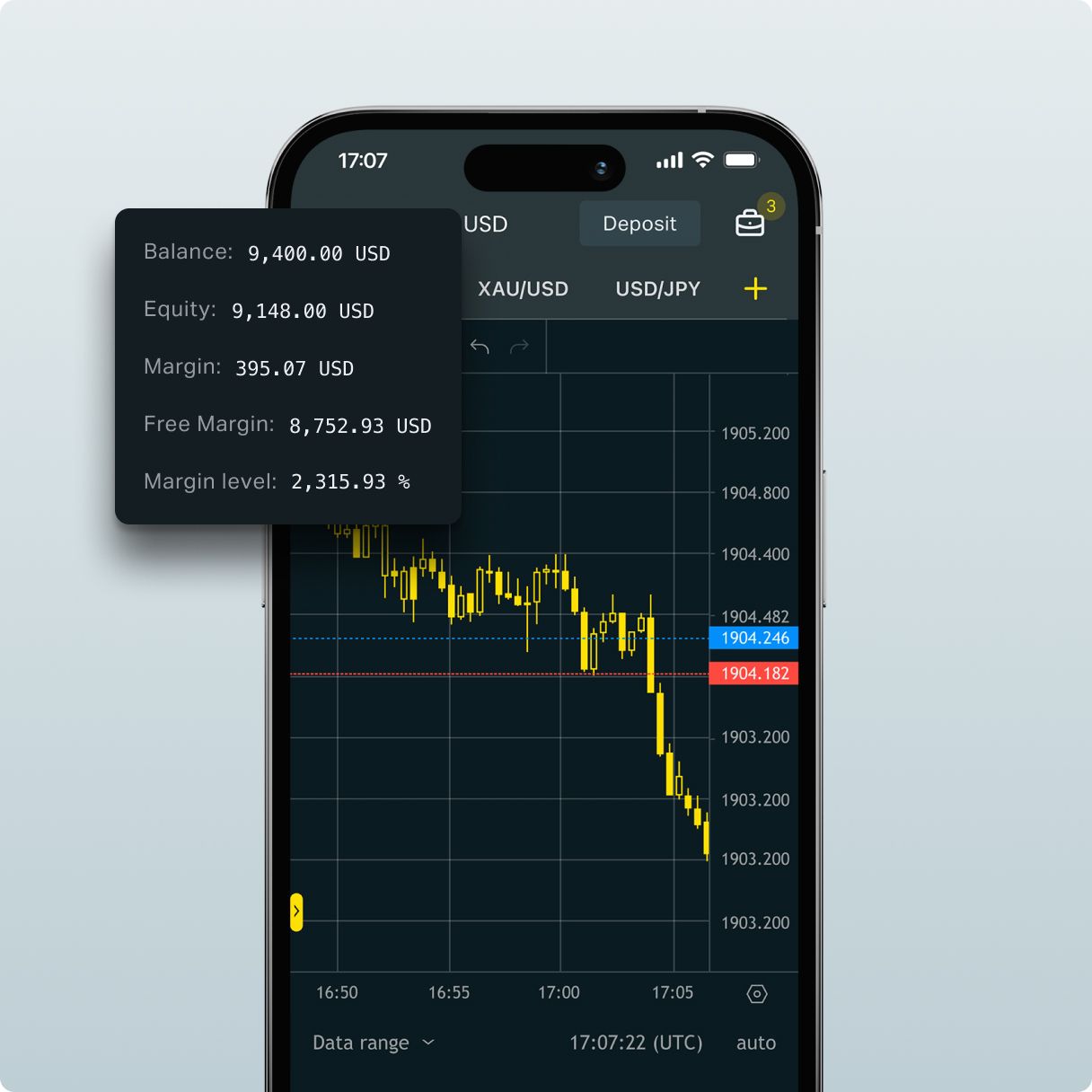

Once you’ve entered the necessary input parameters, the Exness Calculator will display the results based on the details provided. These results help you understand the potential costs and profits associated with your trade. Here are the key results to pay attention to:

| Result | Description | Example |

| Margin | The amount of money you need in your account to open the trade. This depends on your leverage and lot size. | 222.45 USD |

| Spread Cost | The cost of the spread, which is the difference between the buy and sell price of the instrument. This cost varies depending on market conditions and the instrument traded. | 10.00 USD |

| Commission | Any fees charged by Exness for executing the trade. This fee is typically applied on Raw Spread and Zero accounts. | 0 USD |

| Swap Short | The interest you pay or earn if you keep a short (sell) position overnight. This rate varies by instrument and account type. | 0 USD |

| Swap Long | The interest you pay or earn if you keep a long (buy) position overnight. This rate also varies by instrument and account type. | −6.30 USD |

| Pip Value | The monetary value of a one-pip movement in the currency pair you are trading. This value depends on the lot size and the currency pair. | 10.00 USD |

These results give you an in-depth view of the costs and financial implications of your trade, including margin requirements, spread costs, commissions, and swaps. By analyzing these factors, you can better manage your trading strategies and adjust parameters for optimal risk management. The Exness Calculator is a great tool to help you understand these key metrics and improve your trading decisions.

Benefits of Using the Exness Forex Calculator

The Exness Calculator improves your trading by providing precise calculations, saving time, and helping you make informed decisions. This tool helps both beginners and experienced traders manage trades effectively and increase profits.

Key benefits of using the Exness Calculator:

- Accurate Calculations: The calculator gives precise numbers for margin, pip value, and costs. This accuracy minimises errors and helps you avoid costly mistakes.

- Improved Strategy Planning: The calculator offers clear insights into trade costs and requirements. These insights help you refine your strategy and make better trading decisions.

- Time Efficiency: The calculator delivers instant results. This speed allows you to focus on analysing the market instead of spending time on manual calculations.

- Risk Management: The calculator clearly shows the financial impact of each trade. This transparency helps you manage risks more effectively.

- User-Friendly Interface: The calculator is easy to use, even for beginners. You can quickly get the information you need without any hassle.

Tips for Using the Exness Calculator Effectively

These tips help you use the Exness Calculator effectively, making your trading easier and more informed:

- Enter Accurate Inputs: Double-check the account type, currency, instrument, lot size, and leverage. Correct inputs give you precise calculations.

- Know Your Margin: Use the calculator to see how much margin you need. This helps you avoid over-leveraging and reduces the risk of losses.

- Compare Costs: Compare spread costs, swap rates, and pip values across different instruments. This helps you pick the most cost-effective trades.

- Plan Your Trades: Test different scenarios by changing lot size or leverage. See how these changes affect your margin and costs. This helps you manage risks better.

- Use It Anywhere: Access the calculator on your mobile device. Calculate on the go, especially when you need quick decisions in a fast market.

- Check Real-Time Data: Make sure your inputs reflect current market conditions. This ensures the calculator gives you accurate and relevant results.

- Save Time: Get instant calculations with the calculator. This allows you to spend more time analysing the market and less time doing manual maths.

FAQs About the Exness Calculator

What is the Exness Calculator used for?

Traders use the Exness Calculator to perform essential trading calculations. The calculator helps you figure out margin requirements, pip value, spread costs, and swap rates. By providing accurate financial data, it helps you manage your funds and make informed trading decisions.